· Steven Mays · Personal Finance · 4 min read

529 Accounts Make Sense Now

529 accounts have gone from good to great since you can transfer the balance to a Roth IRA.

The 529 account previously was only be useful if you were in a state which had tax advantaged rules. These rules were largely contingent on income requirements, and using the state sponsored benefit plan which may or may not have astronomical fees. But thanks to recent legislative updates, the once narrowly-focused 529 has broadened its horizons. And leading its charge into newfound relevance? The capacity to transfer unused 529 funds into a Roth IRA.

Transcending Education: The Roth IRA

Prior to the updated federal legislation, if your child chose a non-college path, or for some reason you did not use all of the funds, you were penalized with an additional tax burden for withdrawing the funds. The limitations were stringent: use the funds for ‘qualified education expenses’ or face penalties and taxes.

Starting in 2024, 529 account holders will be able to transfer up to a lifetime limit of $35,000 to a Roth IRA for a beneficiary. With these changes, it’s not just about retirement anymore. Unused 529 funds can now be shifted here, serving as a foundational step for a child’s long-term financial security.

While the Roth IRA is typically associated with retirement, its flexibility offers more. Specifically, it can be an avenue for a down payment on a first home. Roth IRAs permit up to $10,000 of earnings to be withdrawn without penalties if used for a first-time home purchase. The 529, through this Roth route, has the potential to lay the first brick for a child’s home.

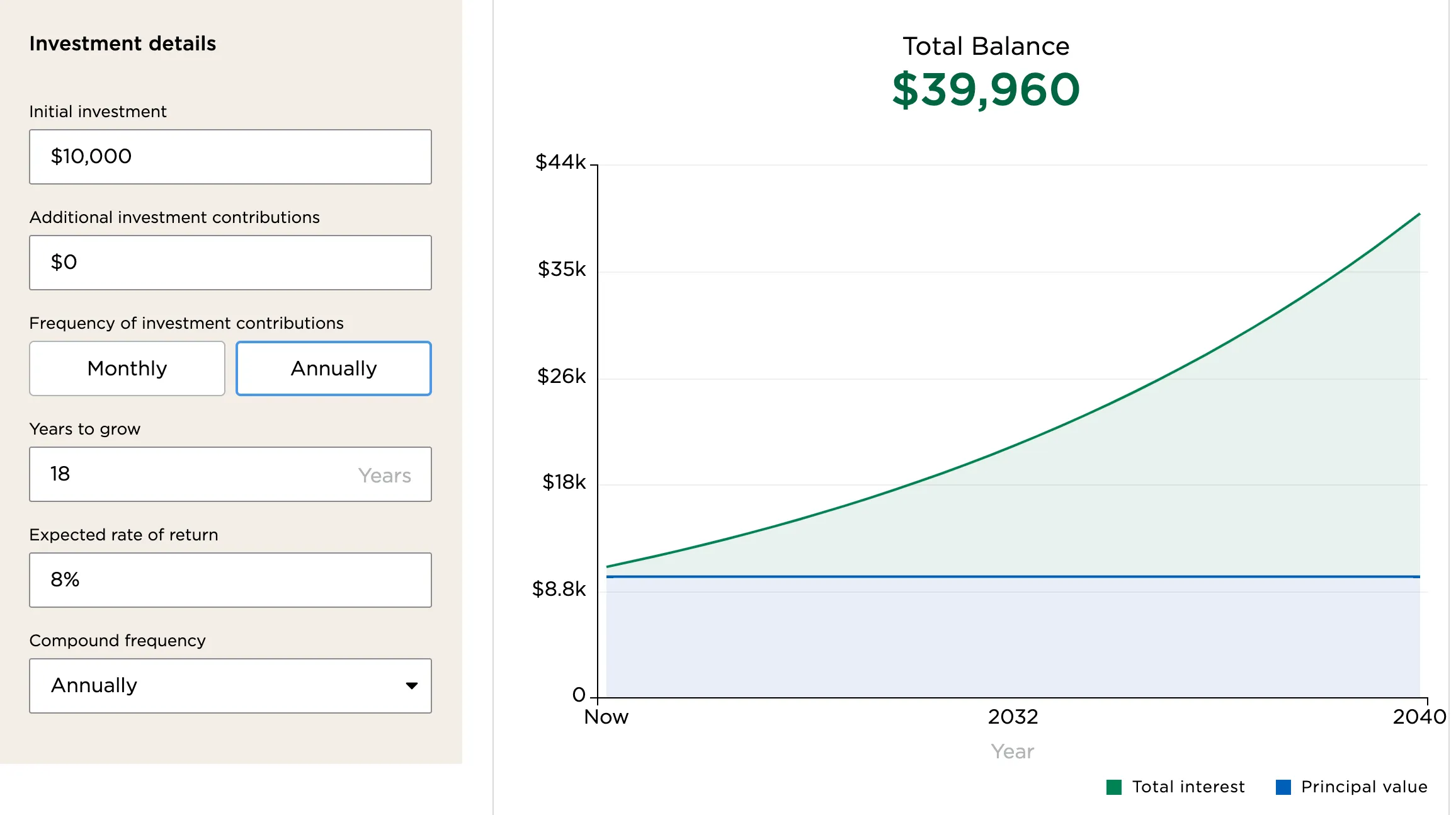

If you start the 529 account when the child is born with $10,000, this account would be expected to grow to just under $40,000 by the time the child is ready for college. If the child decided to use these funds for college that’s wonderful, you’ve gotten them started on the right foot with a great college fund.

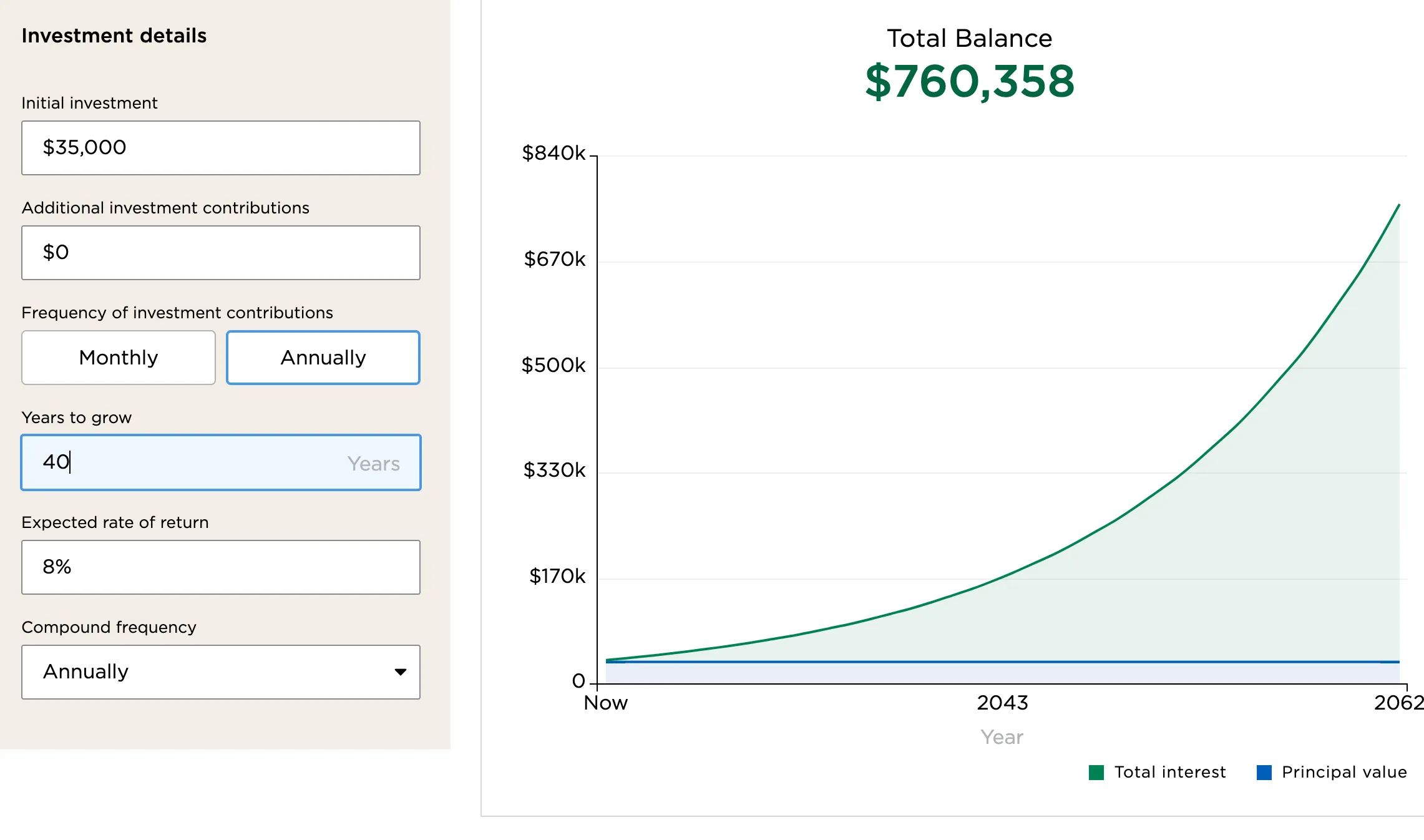

But, what if those funds were not used for college? Or you were able to save more then $10,000 when the child was born. You could then transfer the $35,000 which had compounded into a Roth IRA. Assuming no other contributions your child would have $760,358 around their retirement age - all because their parents had the foresight to do a little planning.

While the Roth transfer is undoubtedly a highlight, other changes have strenghened the 529’s appeal:

Higher Contribution Limits: With increased limits, families can save more, ensuring a robust safety net for future plans.

Broadened Age Limits: Previously reserved mostly for college expenses, 529 plans have now opened their doors to K-12 education expenses, making them more universally relevant.

Integration with Coverdell ESAs: If you’ve been feeding funds into a Coverdell ESA, there’s good news. Rolling these into a 529 plan is now an option, granting greater financial agility.

For many new parents $10,000 is a significant sum. When I set up my daughter’s 529 account, the provider also created an account on ugift, which is that allows others to donate to her 529 account using a code. Giving this link out for birthdays and holidays is one way to get the account funded, and if you’re a parent overwhelmed by toys and clutter you can create a win/win situation.

When setting up your 529 account you need to carefully consider your state’s rules. The state you call home may give additional state level tax incentives. For more information, check out Vanguard’s 529 Plan Tax Benefits By State. Otherwise, you can join any states plan. Vanguard has a plan which is based out of Nevada, and is considered top notch. Any plan you choose is attached to a state, so choose carefully.

When next evaluating your financial strategies, the updated 529 deserves consideration. Beyond mere college savings, it has changed into a versatile financial tool, ready to address both educational and long-term life goals. With these changes, the 529 plan has proven that it is not just a tool for college savings but a comprehensive solution for varied financial needs.